Funding for Flipping was for flippers just like you.

Is lack of Capital Preventing You from Effectively Marketing, Outsourcing, or Operating you Real Estate Investment Empire.

Just like you, we struggled to find a Private Hard Money Source of funding that was reliable, honest, understood the business and had pricing that was based in reality.

We developed this program after years of the Flipping Business. We know what it takes to find money for Flippers Like you. We have the experience and funds available to help you in your Fix & Flip deals.

After years of experience in flipping we have developed a reliable and reasonably priced funding Private Hard Money source for Fix and Flippers.

We can put together a program that is realistic for our industry, and we want to bring it to our fellow flippers.

Imagine Having $50K-$250K Cash

In Your Checking Account For Anything Your Business Needs F4F.com fundingforflippers.com fundingforflipping.com

Flipper Program

Loan Amounts: $50,000 - $3 million

Loan to Value (LTV): up to 90% of the purchase price, plus 100% of the construction funds.

Interest Rates: 8% to 18%*

Points: 1-4 points

Loan Position: 1st TD

Loan Term: 6 or 60 Months

Property Types: Residential, Condos, 2-4 Plex, PUDs

Loan Types: Non-owner occupied residental. Purchase, Refinance, Bridge Loan, Rehab, Business Loans

Commercial Program

Loan Amounts: $250,000 - $25 million

Loan to Value (LTV): up to 60% Loan Type: Acquisition, Refinance, and Cash-Out

Interest Rates: 7.9% to 14%*

Fees: 1 - 3 points

Loan Term: 3 - 260 months.

Property Types: Residential, Condos, 2-4 Plex, PUDs

Loan Types: Non-owner occupied residential, multifamily, retail, office, industrial, mixed use, vacant buildings, and entitled land

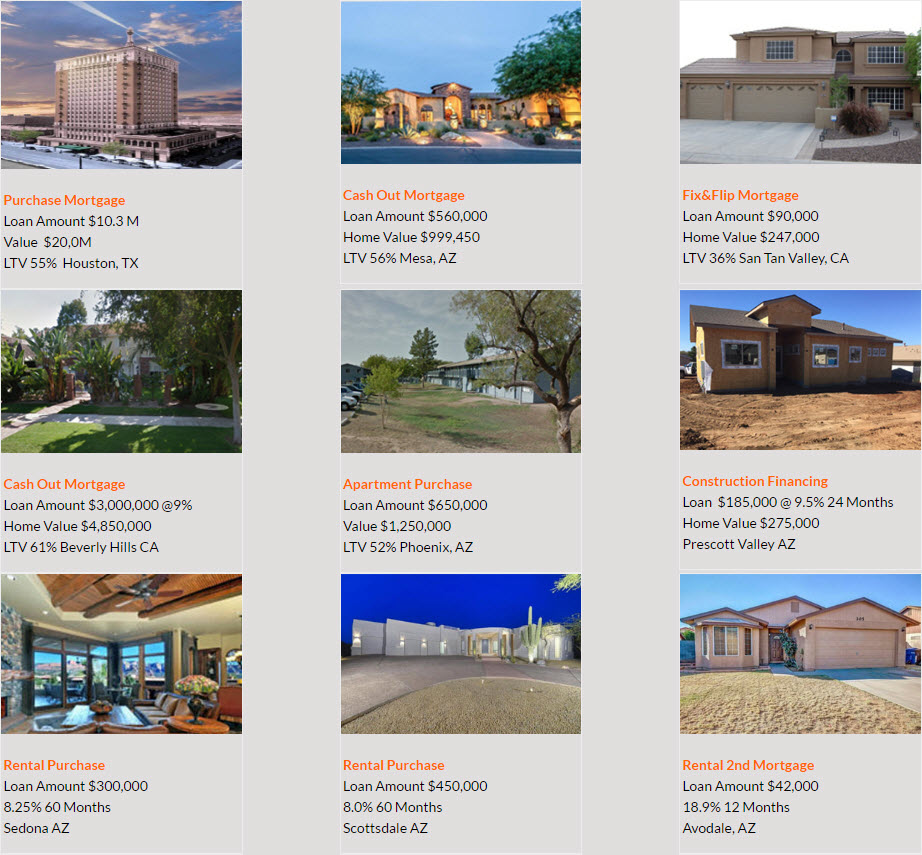

Just Funded Private Hard Money Loans