How Commercial Lending works:

Financing for you next commercial real estate project.

Funding for Multi Family, Warehouse, Industrial, Office.

Up to 90% LTV 50,000,000 available

Quick response and very competitive commercial loan rates

YES we can fund your next development – give us a call to start.

Benefits of Commercial Lending:

- Fast and easy to qualify

- Interest Only Payments

- Allows you flexible short term options 3- 60 Months

Just complete the Get Started and we can give you a quick no obligation quote. ———>

Rate and Terms

UP TO 90% LTV

3-60 Months, Interest Only

From LIBOR + 350%*

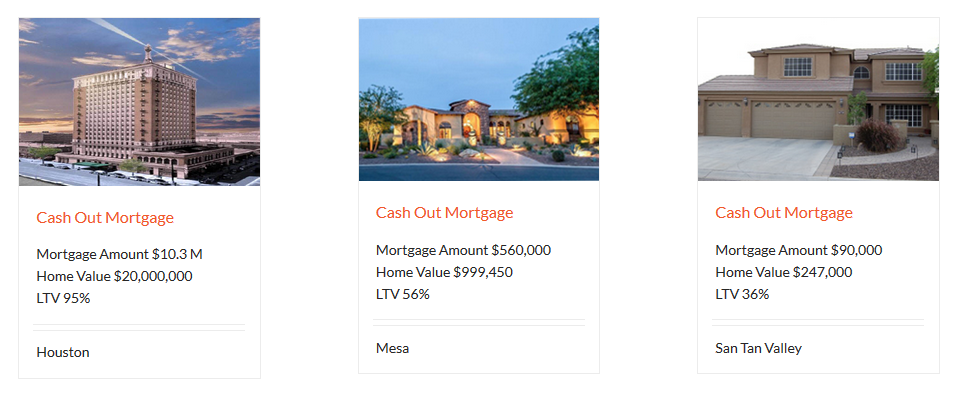

Just Funded by Level 4 Funding

Current News and Information Commercial Lending

How Finding the Right Commercial Lenders Can Benefit Your Business

Commercial lenders are a critical part of helping you navigate the unchartered waters of successfully obtaining a loan for your new, start-up or growing business. Before you apply for a loan, find about more about why having a professional in this area can really benefit your business.

It can be a daunting task to seek out commercial lenders that you feel are going to work for you – but they are out there! They want your business and to work with you to get you the loan you need, so don’t be intimidated by working with a lender. They can help you put your financial state into perspective and help you get out of a tough financial spot, if you’ve found yourself in that position. With loan options that get you cash in hand fast, they are the ones to help you get eligible and approved for these types of loans.

They can also help you find the right loan for you. If you need money and fast, you might want to consider asking your lender about a hard money loan or if you need to cover rent, payroll, etc. A hard money loan or short-term loan may be the way to go. While these loans are typically associated with high interest rates and shorter pay back periods, a lender can help you negotiate these terms so your repayment schedule is reasonable and doesn’t keep you in a tight spot when it comes to your budget.

Before you seek out the help of commercial lenders, it’s a good idea to do a little research on your own. You’ll want to have a basic understanding of the type of loan options available to you, which you think might work best for your business needs and how much money you are in need of. With hard money loans, you can get up to 80 percent loan to value, but about 65 is a more likely percentage. So keep those numbers in mind. You can even find loan calculators online that can give you a ballpark of the amount you’ll be required to pay back depending on your loan amount. It’s also important not to overshoot the loan amount that you actually need.

You don’t even have to leave your house to find the right commercial lenders – start online.

The internet can be a very useful tool when it comes to your initial commercial loan and lender search. You can find a lot of informative facts and methods to help you narrow your search for both loan and lender. You can also find information such as which types of documents you’ll need to present to the lender to help you become eligible for a loan. Starting at home, you can also put your documentation in order and prepare or fine-tune your business plan, which is another essential part of getting a successful loan approval. Look for testimonials or check with the Better Business Bureau to ensure the credibility of the lenders you are looking at before contacting them. Remember, they will have your business finances in their hands, so you want to be sure you can trust them.

Speaking of trust, trust your instincts.

While most commercial lenders have your best interest in mind, there are some less than honorable ones, as with any industry. Make sure you get a good feel for the person who is going to be helping you negotiate your business loan. Look at client reviews, ask questions, and make sure they have good customer service skills, not just expertise in loans.

How To Make Commercial Lenders Want To Invest in You

When you apply for a commercial loan, you may sometimes feel like you are under investigation, but really you should be in the driver’s seat. You can present your loan as an application for commercial lenders to want to support and back your business – here’s how.

Commercial lenders are there to try to get you the best loan, bottom line. And while you may feel that you credit isn’t perfect or you’re a bit unsure about your business plan, you have to remember that rarely do other business owner’s have perfect credit or flawless business plans. So you are not alone. And lenders know that. Think of them as a partner in helping you make your business dreams come true, while giving them an opportunity to invest in your unique business!

Planning and preparing prior to starting the loan application is one of the ways you can make your business more desirable to lenders. Even if you don’t have a perfect credit record, being prepared with all your proper documentation will go a long way towards the success of a lender working to get you the loan you need, and sincerely wanting to invest in your business via the loan.

Know what you want. Sometimes, making the lender’s job easier my coming prepared with the knowledge of exactly what your needs are, what loan you think is best and how much you can reasonably handle for a monthly payback structure is enough to make commercial lenders want to invest in you. This shows you have done your due diligence in terms of research, preparation, updating of all paperwork, and that you are organized and business savvy. Regardless of your financial state, this shows a lot toward the fact that you would be a feasible “risk” for a lender to want to work with.

Don’t try to be something you’re not.

Whether you have a few dings on your credit history or some other less than desirable business matter in your financial history, it’s best to lay all the cards out on the table, versus trying to hide some part of your business history which will inevitably come out in the application process at some point. It’s better to talk through your concerns with commercial lenders to have them best be able to formulate a plan of access that can still result in a successful loan approval process. If you are honest and real, lenders will likely want to help you out.

Lenders want to find a win-win solution for your investment as much as you do.

They are on your side. But it’s up to you to be fully prepared to “win them over.” You can also do so by having in mind some loan collateral to solidify the loan or a down payment amount that you can put down for part of the loan. These things are very desirable when it comes to loans and if you have those, commercial lenders will want to invest in you and your business! These will aid in your loan-to-value requirements as well. Remember they want your

Current News and Information about Commercial Lending

Equal Housing Opportunity.

*APR varies from 3.5 – 14.5%. Your loan rate and how you can borrower is primarily determined by the quality and value of the collateral, your ability to pay, total loan to value and credit score.

This is not a Good Faith Estimate (GFE) and should not be considered as such. Costs, rates and terms can only be determined after completion of a full application. Mortgage rates could change daily. Actual payments will vary based on your individual situation and current rates. To get more accurate and personalized results, please call (623) 582-4444 to talk to one of our licensed mortgage experts. Terms and conditions of this and all loan programs are subject to change without notice. Level 4 Funding LLC is licensed in the State of Arizona, NMLS 1018071 AZMB 0923961. For More Information Click Here

Dennis Dahlberg Broker/CEO/RI

- 22601 N 19th Ave Suite 112

Phoenix AZ 85027

Commercial Lending

Lending for Commercial Development

Commercial Loans - 12 to 60 months

From LIBOR+350*