How Commercial Loans works:

Financing for you next commercial real estate project.

Funding for Multi Family, Warehouse, Industrial, Office.

Up to 90% LTV 50,000,000 available

Quick response and very competitive commercial loan rates

YES we can fund your next development – give us a call to start.

Benefits of Commercial Loans:

- Fast and easy to qualify

- Interest Only Payments

- Allows you flexible short term options 3- 60 Months

Just complete the Get Started and we can give you a quick no obligation quote. ———>

Rate and Terms

UP TO 90% LTV

3-60 Months, Interest Only

From LIBOR + 350%*

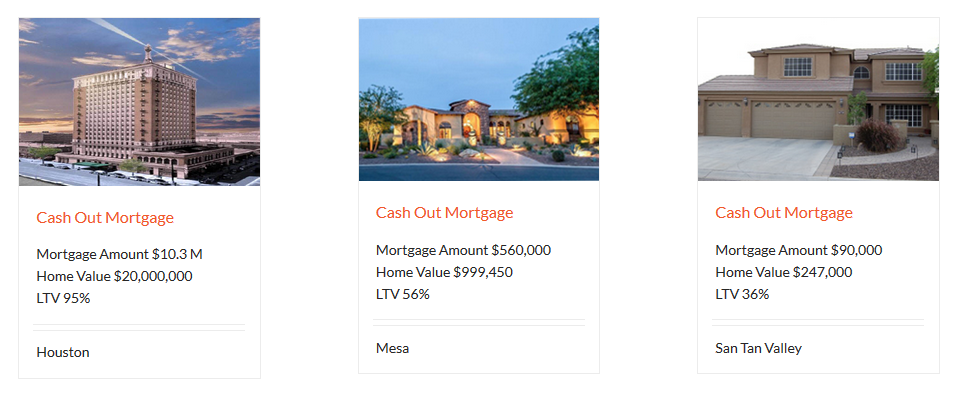

Just Funded by Level 4 Funding

Current News and Information Commercial Loans

What Comes Next For Commercial Loans?

Staying on top of the current movements in both the financial world and in the real estate world is essential for ensuring that you, as a borrower, are able to make the most of your property investments. Commercial Loans, just like any other economic indicator, have ebbs and flows.

After the real estate market crash in 2007, and the subsequent decline through 2012, real estate and property investments have surged back to reach pricing that was very unexpected in the days following the steep decline. However, as with any type of economic surge, there will come a time when that expansion begins to contract.

As a borrower and real estate investor, it is critical for you to stay on top of the tends in commercial Loans so that you can be as prepared as possible to adapt your strategies to best take advantage of the market, whether it be expanding or contracting. With the market beginning to slow, it is important to examine what this might mean for what comes next.

It is no surprise that many investors turn to real estate as a lucrative investment option. It offers a great deal of stability, relative to the market, and it has consistently provided a source of income, as families always need places to live and businesses always need store front or offices spaces to effectively run. Commercial real estate has continued to grow at a slower rate in the past couple of years, but it is growth, nonetheless. However, the growth has become slower in both 2016 and 2017. For those in the business of commercial Loans, this is usually understood to mean that a change in the market is soon coming.

While the recent election of Donald Trump to the presidency has had positive impact on the business, and therefore real estate, confidence, there has also been some concern over the potential for an increase in inflation with the rapid growth for which he has been advocating. This is especially worrisome for those dealing in commercial Loans, due to the fact that threats to inflation often have the consequence of the Treasury raising interest rates in an effort to stabilize the impact. Obviously, rising interest rates from the Treasury department will have a restrictive effect on the real estate market, as fewer individuals and businesses will seek funding, creating a very competitive environment.

What are the potential market reactions to the economic impact on commercial Loans?

There are not too many directions for the real estate market to steer away from the current trajectory that it has been following for the past few years. One would be for the market to adjust. This usually means that one portion of the market alters to meet the demands of the others. Real estate prices might rise, for example, to further slow demand, rather than continue to build the bubble. Another is a market correction. This is the much more dangerous option, as it could potentially lead to unforeseen consequences. The most recent market correction came in 2007 and 2008, when the housing bubble burst, leading to further economic chaos. In either case, there is certain to be an impact on commercial Loans.

How Shifting Demographics Will Affect Commercial Loans and Lenders

With the rise of the millennial generation, there has been a decided shift in priorities regarding living spaces, work areas and recreation. This shift to a centralized urban area has had a profound effect on employers and will also have a decided impact on commercial Loans for urbanized properties.

As a new generation of employees enter and dominate the work force, their values will begin to shape the changing landscape. By bucking the suburban culture in favor of a highly centralized living space that incorporates work, home and play, this new generation has also created a ripple in the real estate industry and commercial Loans.

But how will this actually effect the real estate environment for investors and developers? The safe assumption is that the population will gradually be shifting back to urban centers and away from neighborhoods. For major metropolitan areas, this will mean an even more dense central area.

The effect that this will have on commercial real estate has the potential to be quite profound. Strip malls and commercial areas in outlying areas will decrease in value, as property values of the surrounding area decline in an attempt to stay appealing. With declining retail values, there will be tenants that will be unable to keep up with a rising cost while facing a declining income stream. Commercial Loans will then turn from a necessary expense of expansion to a liability, and could ultimately result in defaults.

While this changing environment might provide low end opportunities for new investors, it also has the potential of being a trap. Just because a property has a low floor does not mean that it has a high ceiling. This will require a great deal of research on behalf of the borrower in order to properly assess whether or not there is profit potential in a property. It will also differ greatly depending on geographic area. What is a good investment in Austin, Texas, might be a disaster in Portland, Oregon.

There is also a great deal of potential for urban development in this chaotic change, however, as commercial Loans for multi-family housing units will most likely become even higher in demand. With more single individuals seeking living space in areas that are close to urban areas and their employment, apartment buildings and other living spaces are sure to increase in demand.

How will this demographic shift affect the development of the suburbs and the disbursement of commercial Loans?

One thing is for sure. If the suburban landscape is going to survive this, things will have to change. The suburbs are going to have to develop an appeal to millennials that rivals that of urban centers. This provides a great deal of opportunity for the creative and savvy investor. Being able to acquire commercial Loans on lower valued properties does have the potential of turning a great deal of profit if it is done correctly. Small businesses might be slow to respond to this, and might not even be able to transport their services and good to a more urban environment. But cultivating an urban feel in a suburban setting, a clever investor stands to turn an excellent profit.

Easy Tips for Getting Approval for Commercial Mortgages

It may seem a daunting task to apply and get approved for commercial mortgages. However, the good news is, there are some tricks to help make the process much easier and less stressful.

Doing your due diligence before applying for a loan for your business is one of the best things you can do to prepare yourself for the application process. There are many things you can do to prepare and little tips such as searching for a local lender to handle your commercial mortgages versus looking for one out-of-state, which may have higher interest rates or not as good of terms as a local lender might.

Think of meeting with lenders for your commercial mortgages as interviewing them to possibly handle your loan. Spend some time meeting with different lenders, with different specialties and think in terms of the fact that they all want your business. So make sure you find the right lender who will get the right loan terms and rates for you and your business. There are definitely deals to be had, so don’t feel you have to settle for higher interest rates or terms that you aren’t comfortable with. And be wary of any lenders asking for money upfront.

Find out what kind of timeframe your lender generally works within to get a loan approved. This can make all the difference when you need cash fast. Some lenders can turn cash around in as little as 24 hours after loan approval, but some conventional lenders like banks take longer. Seek the timeframe that works with your needs.

Make note that only lenders can order appraisals.

Don’t be tricked into thinking that your mortgage brokers can do things that only the lender can (or vice versa). But specifically in the case of appraisals – those have to be ordered by a lender. If they request one, make sure to ask for a term sheet prior. While a term sheet may not have any legal ramifications, it will help outline what you are going to be getting before you sign on the dotted line.

Above all else, put your paperwork in order for your commercial mortgage.

Nothing can slow an approval process down more than not having the proper documentation needed to push the process through quickly and smoothly. Make sure that prior to meeting with lenders and actually going through the approval process you know what you will need to provide in terms of documents so you don’t get caught up in the middle of the process because you need to track down a financial record or credit report. If you can’t provide the right documents, you will likely not get your loan approved. So be prepared and have your documentation organized and ready to go! If you’re not sure what is required of you, do some research online or ask your lender to help you figure out what you will need to have to present in order to ensure the commercial mortgages application process goes smoothly.

Dennis Dahlberg Broker/RI/CEO

Equal Housing Opportunity.

*APR varies from 3.5 – 14.5%. Your loan rate and how you can borrower is primarily determined by the quality and value of the collateral, your ability to pay, total loan to value and credit score.

This is not a Good Faith Estimate (GFE) and should not be considered as such. Costs, rates and terms can only be determined after completion of a full application. Mortgage rates could change daily. Actual payments will vary based on your individual situation and current rates. To get more accurate and personalized results, please call (623) 582-4444 to talk to one of our licensed mortgage experts. Terms and conditions of this and all loan programs are subject to change without notice. Level 4 Funding LLC is licensed in the State of Arizona, NMLS 1018071 AZMB 0923961. For More Information Click Here

Commercial Loans Lenders and Mortgages

Loans for Commercial Development

Commercial Loans - 12 to 60 months

From LIBOR+350*