How Commercial Real Estate Loans

Financing for you next commercial real estate project.

Funding for Multi Family, Warehouse, Industrial, Office.

Up to 90% LTV 50,000,000 available

Quick response and very competitive commercial loan rates

YES we can fund your next development – give us a call to start.

Benefits of Commercial Lending:

- Fast and easy to qualify

- Interest Only Payments

- Allows you flexible short term options 3- 60 Months

Just complete the Get Started and we can give you a quick no obligation quote. ———>

Rate and Terms

UP TO 90% LTV

3-60 Months, Interest Only

From LIBOR + 350%*

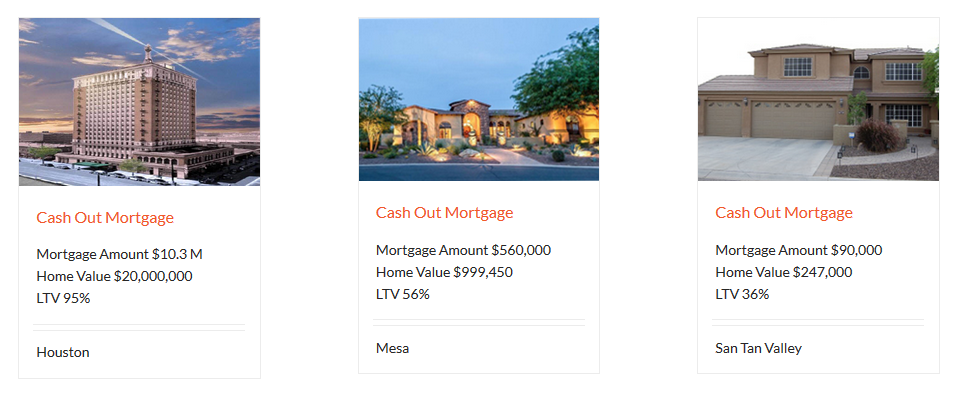

Just Funded by Level 4 Funding

Current News and Information Commercial Real Estate Loans

The “Pros” of Commercial Real Estate Loans for Small Businesses and Start Ups

When it comes time to apply for commercial real estate loans, there are many upsides. There are a few downsides to be aware of, too, so read on to learn more about this type of financing for your small business or start-up company.

If you are ready to start your business or expand it to the next level, you are already well aware that there are going to be ups and downs that come with chasing the “American Dream” of owning your own business and being your own boss. However, there are some things to keep in mind as you navigate the waters of trying to get approved for commercial real estate loans, whether you are looking for an owner-occupied loan or investment property loans.

Owner-occupied loans are loans for commercial facilities that have over 51 percent of the building that the owner occupies. As a start-up or small business owner, this type of loan can help you keep your costs lower by having tenants that pay you rent. This is a great benefit of this type of loan.

Investment property loans are typically for commercial buildings like office complexes or strip malls that have multi-unit storefronts and can be used to buy or refinance with. The downside is with these loans is that they sometimes have higher rates, however, and a balloon payment that might come too soon before you can actually pay it off. This loan is ideal if you are making an investment on the property or building but not actually using it for your business. Of these two options, owner-occupied commercial real estate loans have more “pros” for start-ups and small business owners than investment property loans.

There are also many pros to owning your own business storefront.

Owning commercial property has upsides in its own right, including the very nice tax advantages, asset appreciate, high cash yields and more. With the remaining 49 percent of the property being sublet to your tenants, you have the advantage of receiving rent from tenants that you can then use to pay off your loan. Now that is a financial win-win solution! Having a storefront is also great brand recognition and helps establish creditability for your company. Purchasing a commercial property with commercial real estate loans is definitely the way to go, and it has many pros.

As with anything, there are a few downsides to this type of commercial real estate loans as well.

When you are starting out in business, it can be difficult to keep up with the added costs that are associated with a loan such as title work, appraisals, getting documentation and other “hidden fees” right down to specific fees from your lender. There is also the “con” of being responsible for the management and maintenance of the building you now own. Your tenants will come to you when they need something fixed, repaired or upgraded. And as the commercial property owner, you are solely responsible for taking care of those things for your tenants. So be prepared for all the pros and cons that come along with these loans before you proceed.

What You Should Know Before Seeking Financing for Your First Commercial Real Estate Loans

Obtaining a business loan for the first time can be a complex and confusing process. However, read on to learn how you can be prepared to apply for commercial real estate loans for the first time.

If you’re looking to take on an investment, whether it’s a new building for your company, an office complex, hotel or strip mall, its likely you’ll need to obtain commercial real estate loans to help you through the financial end of this process. There are some things you should be aware of to make the process easier for first time loan applicants.

One of the first things you should prepare for is the status of your credit report. It’s not the only thing lenders look at when reviewing a loan application, but it’s certainly one of the major factors and a big reason why loan applications are often rejected. Banks simply don’t like to take risks, and poor credit is a “red flag” thatyou might not be able to pay back your commercial real estate loans. So make sure your credit score is favorable and your history is clean. If there are any issues, resolve them prior to applying for financing.

You want to make sure you can present the best credit score and report possible, it’s okay if you have credit history. For example, don’t feel obliged to close out old accounts before applying for commercial real estate loans. Proving you have the ability to pay back credit is a good thing when it comes to getting approved for financing for the first time. Make sure to get an updated credit report once you’d put your credit in order to show the current state of your credit score and history.

Be prepared to put some money down to ensure your commercial real state loan gets approved.

When it comes to obtaining financing for the first time, even if you are approved for a large cash amount, you are still required to put some money down. It’s typical to have to a down payment of at least 20 percent. You can also consider taking out a second mortgage if you are not prepared to make a down payment. You can also seek owner financing if that suits your specific business needs.

Put your affairs in order before deciding on an investment property.

You don’t have to wait to find the perfect building, hotel or shopping center to apply for a loan. If you do, you might lose out on an investment property due to a lag or wait time of the loan approval process. Have your ducks in a row prior to searching for properties so you can be prepared to lock in the right investment when you find it. Once you have your documents in order, you can confidently apply for financing knowing that you have your proper paperwork in order and you won’ have to worry about a tight timeframe or that perfect investment property getting away because you weren’t ready for the application process.

Current News and Information about Commercial Lending

Equal Housing Opportunity.

*APR varies from 3.5 – 14.5%. Your loan rate and how you can borrower is primarily determined by the quality and value of the collateral, your ability to pay, total loan to value and credit score.

This is not a Good Faith Estimate (GFE) and should not be considered as such. Costs, rates and terms can only be determined after completion of a full application. Mortgage rates could change daily. Actual payments will vary based on your individual situation and current rates. To get more accurate and personalized results, please call (623) 582-4444 to talk to one of our licensed mortgage experts. Terms and conditions of this and all loan programs are subject to change without notice. Level 4 Funding LLC is licensed in the State of Arizona, NMLS 1018071 AZMB 0923961. For More Information Click Here

Dennis Dahlberg Broker/CEO/RI

- 22601 N 19th Ave Suite 112

Phoenix AZ 85027

Commercial

Real Estate Loans

Lending for Commercial Development

Commercial Loans - 12 to 60 months

From LIBOR+350*