How Commercial Real Financing Works

Financing for you next commercial real estate project.

Funding for Multi Family, Warehouse, Industrial, Office.

Up to 90% LTV 50,000,000 available

Quick response and very competitive commercial loan rates

YES we can fund your next development – give us a call to start.

Benefits of Commercial Real Estate Financing:

- Fast and easy to qualify

- Interest Only Payments

- Allows you flexible short term options 3- 60 Months

Just complete the Get Started and we can give you a quick no obligation quote. ———>

Rate and Terms

UP TO 90% LTV

3-60 Months, Interest Only

From LIBOR + 350%*

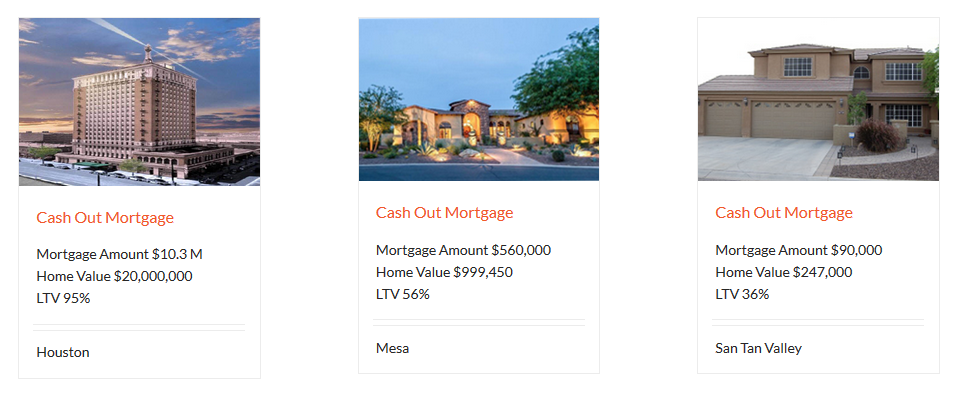

Just Funded by Level 4 Funding

Current News and Information Commercial Real Estate Financing

How Commercial Real Estate Financing is Different from Residential Real Estate Financing

For most people, purchasing a home with a residential real estate loan comes before starting a business with commercial real estate financing. And the fact is, the two are very different processes so it’s important to know what to expect when it comes to your business loan.

As a homeowner, you may have already gone through the process of applying for and obtaining a residential real estate loan. And that is a good thing when it comes to what to expect with some of the processes of applying for and obtaining a commercial loan for your business.

However, there are also some distinct differences in the processes, documentation required and terms when applying for commercial real estate financing for your business. Many lenders can assist you with ease and help you get the loan you need to get your company up and running fairly quickly.

When applying for commercial lending, you’ll need to have specific paperwork and documentation ready to present. You will also need to decide if you are going to apply through a conventional bank lender or seek an alternative lender for your commercial loan options. It’s also important to know that it’s not about the state of your personal income that matters when applying for commercial real estate financing. While that may have been an instrumental part of getting your residential home loan approved, your personal finances are not typically considered in a business loan. What matters more is the profitability of your business or property.

Property is important, but there are other things to consider.

You will need to have prepared your financial information for your lender such as business income, expenses, payroll, rent, and more. You will also need to have statements such as bank statements, tax returns, a solid business plan and credit record. Having all your documentation in good order is a key to getting your loan approved for your business.

Working with a lender can be a win-win solution to helping you be eligible for commercial real estate financing.

Lenders can be the key to unlocking the various options available to you when seeking funding for your business. Once you are prepared to give them all the documentation they need to process your application, they can help you determine the type of loan you need and the best terms, rates and more to make sure you get the loan you need. They can also help you negotiate all the fees associated with applying for a loan and the terms over the course of the loan repayment schedule. So what are you waiting for? A lender can be your ally when it comes time for you to move on from real estate loans to a commercial loan to start a company. Call a lender today and get your business off the ground with the financing you are eligible for!

What to Ask Yourself Before Seeking Commercial Real Estate Financing

You may have many questions running through your head if you have reached a point in your business that you feel you need to obtain commercial real estate financing. Here are the questions you should be asking yourself.

When you meet with a lender, whether you are just starting your company or have been in business for years and are looking to expand, you will likely be met with challenges prior to immediate approval. Here are some questions to ask yourself to make sure you are prepared to apply for commercial real estate financing.

“How much do I need to borrow?” It’s important to establish this number early on and estimate as close as possible to the amount you actually need. You don’t want to borrow way beyond what your needs are, and be in a bind trying to repay the monthly payback structure. Determining this number may involve figuring cost of a building or monthly rent, equipment purchases, inventory and more. Factor in all your needs but be conservative with your loan amount needs.

“Will the loan allow me to increase business profits?” One of the best reasons to take out a business loan is to be able to grow your business to a more successful money making machine. But as the old saying goes, it takes money to make money. You’ll want to be able to prove to a lender that with commercial real estate financing you will be able to increase profitability of your business, which is a win-win solution for you and your lender.

There is another final question you should ask yourself before trying to obtain Commercial Real Estate Funding.

“Will I be able to get approved for the loan I need?” Make sure you have your credit record up to date and your business plan polished and ready to present. You should also have other paperwork and documentation in order such as other financial statements, bank statements, and more. A professional lender can help you determine which financial records you’ll need to provide during the loan approval process.

Once you’ve asked yourself these questions, it’s time to seek a professional lender to help you get the best commercial real estate financing rates.

Going it alone when trying to get loan approval can be done, but you and your business will likely benefit from the professional and skilled advice of an experienced lender. A lender can offer advice on what type of loan you might need and how to best prepare for the loan application process.

Current News and Information about Commercial Lending

Equal Housing Opportunity.

*APR varies from 3.5 – 14.5%. Your loan rate and how you can borrower is primarily determined by the quality and value of the collateral, your ability to pay, total loan to value and credit score.

This is not a Good Faith Estimate (GFE) and should not be considered as such. Costs, rates and terms can only be determined after completion of a full application. Mortgage rates could change daily. Actual payments will vary based on your individual situation and current rates. To get more accurate and personalized results, please call (623) 582-4444 to talk to one of our licensed mortgage experts. Terms and conditions of this and all loan programs are subject to change without notice. Level 4 Funding LLC is licensed in the State of Arizona, NMLS 1018071 AZMB 0923961. For More Information Click Here

Dennis Dahlberg Broker/CEO/RI

- 22601 N 19th Ave Suite 112

Phoenix AZ 85027

Commercial

Real Estate Financing

Lending for Commercial Development

Commercial Loans - 12 to 60 months

From LIBOR+350*