Fix and Flip Loans

Rates from 7.99% APR*

3-60 Months Terms

Fast Closing

If You Are Not Using Level 4 Funding

You Are Paying Way Too Much

Arizona - Neveda - Texas

Fix and Flip Rates and Terms

• Flexible Terms From 3 to 60 Months

• Fixed Rate From 7.99% APR*

• Up to 90% As-Is Value, 100% of Rehab Costs

• Fix&Flip and Cash Out Loans

Fix and Flip Rates and Terms

• Flexible Terms From 3 to 60 Months

• Fixed Rate From 7.99% APR*

• Up to 90% As-Is Value, 100% of Rehab Costs

• Fix&Flip and Cash Out Loans

How do you get started?

• Give Us a Call at 888-582-0714 or

• Fill out Free Quick Application Online Click Here

• Down Loan Application Click Here and Email to Dennis@Level4Funding.com or

• Chat With Us on the Live Chat Button or Give Us a Call at 623-582-4444

• No Cost to Ask Us

Give me a call to discuss your project.

I'm really interested in hearing what you are doing.

I know what you are going through. I started flipping homes 40 years ago.

Love to talk to you and can give you a quick answer.

If You are Not Using Level 4 Funding, You are Paying Way Too Much.

Dennis Dahlberg

Broker/RI 888-582-0714

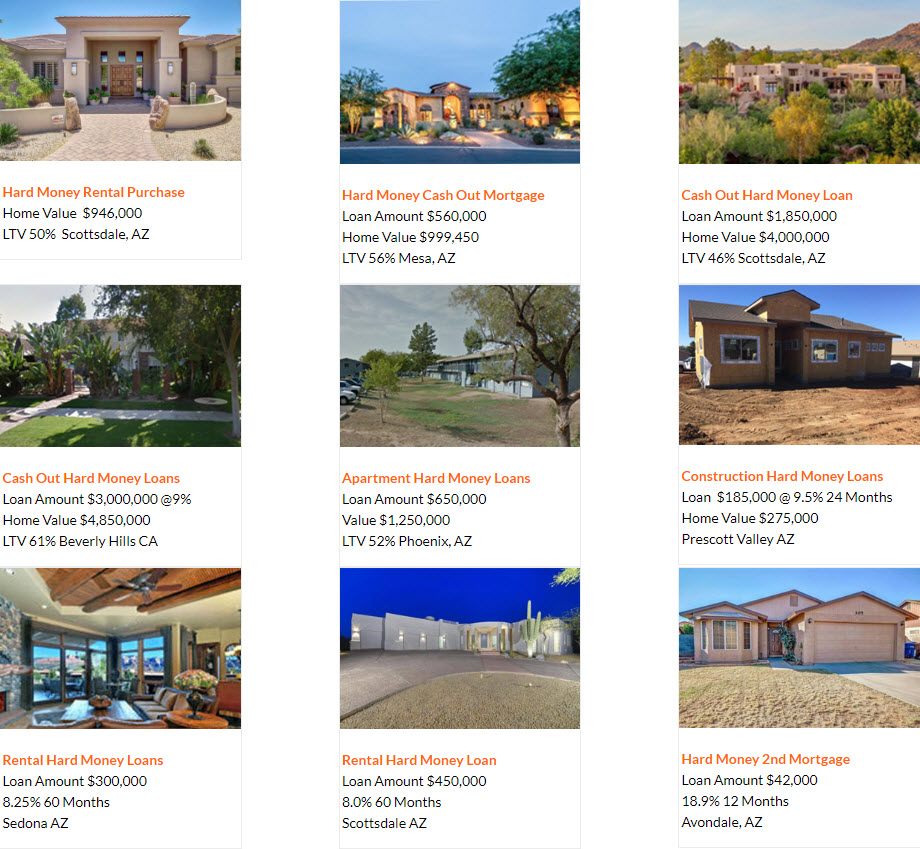

Just Completed Loans - You are Next!

Over $200,000,000 Funded!

Top 3 Mistakes Newcomers to Arizona Fix and Flip Loans Make

Home rehabbers are always on tight schedules, but when you leverage Arizona Fix and Flip Loans as opposed to self-financing, it’s that much more important to keep your project on track. Become familiar with the top three mistakes newcomers make in order to ensure a smooth and profitable exit.

Not padding the timeline. The work of various professionals assisting you are often dependent on the others staying on track. For example, your drywaller may not be able to take over until your electrician is done or your cabinet installer may not be able to work until the tiler has finished. If one early in the chain is delayed, it will set everyone else back too. Sometimes suppliers are sluggish a slow in the market can delay the sale. Always pad your timeline some, so that unforeseen issues don’t push you past your intended exit date.

Not padding your expenses. Having the property inspected by a professional is a must, especially if you don’t have much experience in the area on your own. That said, there are sometimes things you cannot foresee. Perhaps you pull up the carpet and discover mold and water damage or you open a wall and find out the prior homeowner was clearly not an electrician or a plumber, but attempted to be one. You’ll likely have a legal and ethical obligation to set things right. Without extra room in your budget, this will eat away at your profits or could even leave you upside-down.

Forgetting about government regulations. After the housing crisis, guidelines for FHA loans changed. This doesn’t impact your ability to get Arizona Fix and Flip Loans, but it may impact who can purchase your home and when. There are a couple areas to address here. FHA loans can be good for borrowers who wouldn’t ordinarily qualify for a mortgage. The government insures the loan to protect the lender, but the borrower then has additional fees to pay. For this reason, the location you’re working in will impact whether or not your buyers will want this form of financing. If you’re working in luxury homes, they won’t be, but if you’re working in struggling or up-and-coming neighborhoods, they could be. If you are in an area where buyers may need an FHA loan, they will not be allowed to purchase yours until it’s been in your possession for 90 days if your sales price is two or more times what you paid for it.

With Planning and Foresight, You Will Have a Successful Project

The more you work with Arizona Fix and Flip Loans and rehab projects in general, the easier it will become to identify issues in these three core areas and avoid them. However, for your initial ventures, it’s a good idea to give yourself a fair amount of breathing room and simply anticipate there being unforeseen circumstances, so you never fall short on time or money.

Develop a strong network and they’ll be there when you need them.

It can be frustrating when a supplier sends out the wrong thing or delays a shipment, particularly when that makes the schedules of your tradesmen fall like dominoes. However, the more you work with your team and the better you treat them, the more likely they are to prioritize your needs over all the other projects they do. Your Arizona Fix and Flip Loans will go further and you’ll be more successful too.

Make Money with Arizona Fix and Flip Loans

When you want to make a good return on your investment, get Arizona Fix and Flip Loans. They give you more money to make money with in the real estate market.

Flipping homes is a huge trend right now because it makes people big money. You can see how much money it makes people by just Googling it.

The problem is that many people do not have the cash to invest in the real estate market. They can’t buy the investment property – the home they need to fix to flip.

This is where Arizona Fix and Flip Loans come in to help.

How to Use Arizona Fix and Flip Loans to Make Big Money

You can use Arizona Fix and Flip Loans easily to make big money. These loans are specifically for buying a home that you will fix up and then sell for more than you paid for it.

The homes you purchase to fix will need a decent amount of work, but that is okay. It is well worth the effort and time you put into it when you can make tens of thousands of dollars more than what you paid.

The process is quite easy. All you have to do is find a property you would like to purchase. You can usually get help from a real estate agent. Once you find your fixer upper, contact an Arizona Hard Money Lender that offers Arizona Fix and Flip Loans.

Since Arizona Hard Money Lenders are private, you can get the money you need to purchase the house in just a couple of days. They will approve you within hours, and then deposit the money into your bank. Since you have the cash to purchase the house, it doesn’t take long to close.

Once you have the house in your name, you can start fixing it and making improvements that will help you sell it for more than you purchased it for. This should only take a couple of months to finish, and then you can put it back on the market.

When the house sells, you simply pay back the Arizona Fix and Flip Loan and pocket the rest of it as profit. You can then move on to buying another one to profit from that one and so on and so forth. Many people are able to make a lot of money by flipping homes, so don’t let this chance pass you by.

It all starts with contacting an Arizona Private Money Lender.

Contact us today for more information on how you can use an Arizona Private Money Lender for Arizona Fix and Flip Loans. Once you have the means to get the cash needed to purchase the house, you can move on to finding your fixer upper.

We look forward to helping you make a lot of money in real estate investing.

Meet The Broker

Dennis Dahlberg Dennis brings with him substantial experience in residential real estate. Dennis has extensive experience about purchasing, renting and selling numerous homes over the past 40 years. His first purchase was a property in California when he was 18 years old.

Dennis holds a Bachelor of Science in Business Administration from California State University with majors in Computer Science and Business Management.

He is an Licensed Mortgage Broker, Licensed Mortgage Originator, Licensed Real Estate Agent, Licensed Insurance Agent in Life /Health/ Property /Casualty Agent, Certified Sort Sales Specialists (CSS), Certified Negotiator (CNE), Certified Land Specialists, Certified Web/SEO Specialists, ATF Licensed Firearms/Explosives Specialists and FAA Licensed Private Pilot.

Married for 42 years with two girls and 5 grandchildren and an Arizona resident for the past 40 years. Licensed AZ MB 0923961, Licensed AZ MLO NMLS 1057378.