How Commercial Lenders works:

Financing for you next commercial real estate project.

Funding for Multi Family, Warehouse, Industrial, Office.

Up to 90% LTV 50,000,000 available

Quick response and very competitive commercial loan rates

YES we can fund your next development – give us a call to start.

Benefits of Commercial Lending:

- Fast and easy to qualify

- Interest Only Payments

- Allows you flexible short term options 3- 60 Months

Just complete the Get Started and we can give you a quick no obligation quote. ———>

Rate and Terms

UP TO 90% LTV

3-60 Months, Interest Only

From LIBOR + 350%*

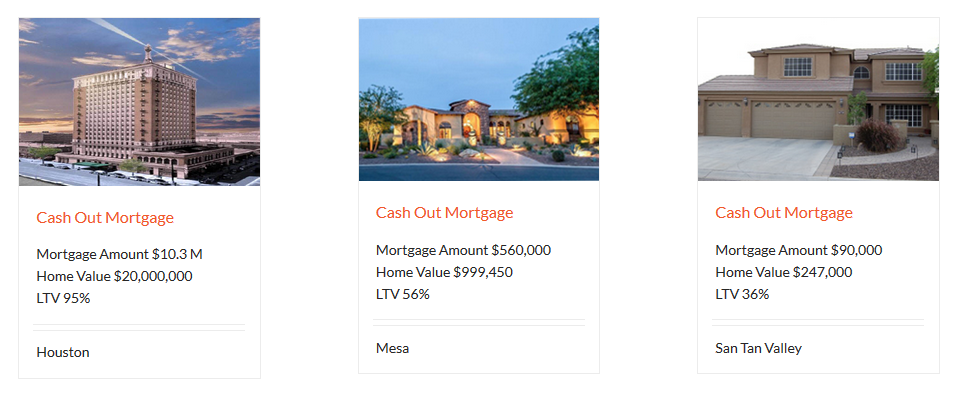

Just Funded by Level 4 Funding

Current News and Information Commercial Lending

How Finding the Right Commercial Lenders Can Benefit Your Business

Commercial lenders are a critical part of helping you navigate the unchartered waters of successfully obtaining a loan for your new, start-up or growing business. Before you apply for a loan, find about more about why having a professional in this area can really benefit your business.

It can be a daunting task to seek out commercial lenders that you feel are going to work for you – but they are out there! They want your business and to work with you to get you the loan you need, so don’t be intimidated by working with a lender. They can help you put your financial state into perspective and help you get out of a tough financial spot, if you’ve found yourself in that position. With loan options that get you cash in hand fast, they are the ones to help you get eligible and approved for these types of loans.

They can also help you find the right loan for you. If you need money and fast, you might want to consider asking your lender about a hard money loan or if you need to cover rent, payroll, etc. A hard money loan or short-term loan may be the way to go. While these loans are typically associated with high interest rates and shorter pay back periods, a lender can help you negotiate these terms so your repayment schedule is reasonable and doesn’t keep you in a tight spot when it comes to your budget.

Before you seek out the help of commercial lenders, it’s a good idea to do a little research on your own. You’ll want to have a basic understanding of the type of loan options available to you, which you think might work best for your business needs and how much money you are in need of. With hard money loans, you can get up to 80 percent loan to value, but about 65 is a more likely percentage. So keep those numbers in mind. You can even find loan calculators online that can give you a ballpark of the amount you’ll be required to pay back depending on your loan amount. It’s also important not to overshoot the loan amount that you actually need.

You don’t even have to leave your house to find the right commercial lenders – start online.

The internet can be a very useful tool when it comes to your initial commercial loan and lender search. You can find a lot of informative facts and methods to help you narrow your search for both loan and lender. You can also find information such as which types of documents you’ll need to present to the lender to help you become eligible for a loan. Starting at home, you can also put your documentation in order and prepare or fine-tune your business plan, which is another essential part of getting a successful loan approval. Look for testimonials or check with the Better Business Bureau to ensure the credibility of the lenders you are looking at before contacting them. Remember, they will have your business finances in their hands, so you want to be sure you can trust them.

Speaking of trust, trust your instincts.

While most commercial lenders have your best interest in mind, there are some less than honorable ones, as with any industry. Make sure you get a good feel for the person who is going to be helping you negotiate your business loan. Look at client reviews, ask questions, and make sure they have good customer service skills, not just expertise in loans.

How To Make Commercial Lenders Want To Invest in You

When you apply for a commercial loan, you may sometimes feel like you are under investigation, but really you should be in the driver’s seat. You can present your loan as an application for commercial lenders to want to support and back your business – here’s how.

Commercial lenders are there to try to get you the best loan, bottom line. And while you may feel that you credit isn’t perfect or you’re a bit unsure about your business plan, you have to remember that rarely do other business owner’s have perfect credit or flawless business plans. So you are not alone. And lenders know that. Think of them as a partner in helping you make your business dreams come true, while giving them an opportunity to invest in your unique business!

Planning and preparing prior to starting the loan application is one of the ways you can make your business more desirable to lenders. Even if you don’t have a perfect credit record, being prepared with all your proper documentation will go a long way towards the success of a lender working to get you the loan you need, and sincerely wanting to invest in your business via the loan.

Know what you want. Sometimes, making the lender’s job easier my coming prepared with the knowledge of exactly what your needs are, what loan you think is best and how much you can reasonably handle for a monthly payback structure is enough to make commercial lenders want to invest in you. This shows you have done your due diligence in terms of research, preparation, updating of all paperwork, and that you are organized and business savvy. Regardless of your financial state, this shows a lot toward the fact that you would be a feasible “risk” for a lender to want to work with.

Don’t try to be something you’re not.

Whether you have a few dings on your credit history or some other less than desirable business matter in your financial history, it’s best to lay all the cards out on the table, versus trying to hide some part of your business history which will inevitably come out in the application process at some point. It’s better to talk through your concerns with commercial lenders to have them best be able to formulate a plan of access that can still result in a successful loan approval process. If you are honest and real, lenders will likely want to help you out.

Lenders want to find a win-win solution for your investment as much as you do.

They are on your side. But it’s up to you to be fully prepared to “win them over.” You can also do so by having in mind some loan collateral to solidify the loan or a down payment amount that you can put down for part of the loan. These things are very desirable when it comes to loans and if you have those, commercial lenders will want to invest in you and your business! These will aid in your loan-to-value requirements as well. Remember they want your

The Most Important Questions To Ask Your Commercial Lender Before Signing Your Loan Documents

Before getting a commercial real estate loan, there is a lot to make sure you understand. In addition to researching answers to your questions online your commercial lenders is a wonderful resource so make sure to ask the following questions.

Doing your due diligence to find out what you need to know about obtaining a commercial business loan is step one. However, even after doing some research, there may still be questions that you don’t even know to ask! Getting a loan is a complex process, and it’s a good idea to be as prepared as possible — and knowledge is power! So educate yourself to the best of our ability, first, and then ask for the help of a professional. Before meeting with a commercial lender, make sure you are prepared with all the proper documentation so you feel in control of the situation, and then ask these questions.

“Are you experienced with my type of project?” You want to make sure the lender you choose has similar projects to yours in their portfolio. This ensures they have “been down this road before” and knows how to navigate the loan process specific to your own project needs. If they don’t have specific experience with your type of project, ask what their areas of expertise are and see if they align closely with your needs. If they have experience in a similar industry or loan size, they can still be a good fit.

“How can I get the best rate and how long can I lock it in?” Of course every borrower wants to get the best rates and terms, and a good commercial lender wants to find it for you! Be sure to discuss all terms, and see if you can get a guarantee that the rate you discuss will indeed be the same rate you have on paper. You can also ask about conditions of the rate, any additional costs associated with the loan application and approval process or hidden fees that could appear down the line. Another question to ask is, “When will my loan close?” If you’re applying for a loan, you likely need money and you probably want it sooner rather than later. So this is a legitimate question that your lender may not be able to answer exactly, but they should be able to give you a ballpark timeframe. There are outside factors and third parties such as legal teams and appraisals that can slow the process. The lender should still be able to offer a reasonable timeframe of responsive service.

Before meeting with a commercial lenders, there are a few more things you can ask yourself.

“Do I have to work with a conventional lender?” The short answer is no. There is a wide array of traditional and alternative lending options available to you and you should find whichever route is best for you and your business. Don’t get locked into a specific loan type either. Do your research on the types of lenders and types of loans that can take your business to the next level and remember there are always other options. Conventional banks often have stricter regulations, but private lenders can provide more specialized loan terms so find what’s right for you.

Ask yourself one final question…

“Am I prepared?” There is a lot of prep work that comes along with trying to successfully obtain a loan so take your time putting together your business plan, up-to-date credit report, financial statements, and more to ensure that you appear ready to go when you meet with a lender about your loan options.

The Biggest (and Best) Reasons to Use a Commercial Lenders for Your Loan

(When it comes time to seek a loan whether you are just starting out in business or you need a cash advance to take expand your current business, a commercial lender can be a win-win solution for your financing needs. Read on to find out some of the biggest reasons why.)

If you are just starting your own business or if your company is ready to grow to another location or expand into another market, seeking a loan can be a great way to get the cash you need, and fast, in some cases. Using a commercial lender to help you obtain a loan is a great option to get the money you need to help your business.

These lenders specialize in the loans you need, and are able to help process them quickly and effectively – which equates to you getting your financing faster. These professionals have the expertise and knowledge to be able to maneuver through the process and can get you the best terms and rates for your budget. Working with a lender of this sort is also often quicker and easier than working with a convention bank that often requires a lot of hoop jumping and red tape to get a loan approved. The process can take many weeks with a traditional bank lender.

So you’re credit history has a ding or two, or you have yet to even establish a credit report as a new business owner. Don’t worry – a commercial lenders is more likely to have leniency with this type of situation than a conventional bank would. They can more easily work around your less than perfect credit or other reasoning why your application might not be as squeaky clean as a traditional lender requires it to be to approve the loan. The most important thing these lenders are looking to see is if you can prove that you will be able to pay back the loan they are providing.

Forget what you think you know about these commercial lenders.

In the past, not going with a conventional bank for your loan and instead seeking an alternative lending option may have seemed like a sketchy endeavor, that is no longer the case. These are professionals that can help you get the financing you need with the rates and terms that work or you. They are here to make your loan application process a successful one, because that is a win-win solution for you and them!

Do your research when you are looking for financing options.

A commercial lenders can help you secure the funds you need to catapult your business to the next level or to finally take the leap from working for someone else all the time and finally becoming your own boss and living our your own dream of owning a business. So what are you waiting for? The loan you need is out there waiting for you and so is the lender who can help you obtain it.

Current News and Information about Commercial Lending

Equal Housing Opportunity.

*APR varies from 3.5 – 14.5%. Your loan rate and how you can borrower is primarily determined by the quality and value of the collateral, your ability to pay, total loan to value and credit score.

This is not a Good Faith Estimate (GFE) and should not be considered as such. Costs, rates and terms can only be determined after completion of a full application. Mortgage rates could change daily. Actual payments will vary based on your individual situation and current rates. To get more accurate and personalized results, please call (623) 582-4444 to talk to one of our licensed mortgage experts. Terms and conditions of this and all loan programs are subject to change without notice. Level 4 Funding LLC is licensed in the State of Arizona, NMLS 1018071 AZMB 0923961. For More Information Click Here

Dennis Dahlberg Broker/CEO/RI

- 22601 N 19th Ave Suite 112

Phoenix AZ 85027

Commercial Lenders

Lending for Commercial Development

Commercial Loans - 12 to 60 months

From LIBOR+350*